Oh-em-gee, you guys (and gals and non-gender-conforming readers who prefer to be called neither guys nor gals but are equally welcomed and appreciated): Didja hear?! Google's Pixel sales are, like, totally tanking. The company's entire self-made smartphone program is probably gonna be outright cancelled any second now — because it is just struggling and flailing and several other overly dramatic verbs.

That's the narrative that seems to be building up 'round these here nets of inter at the moment, anyhow — but you know what? While it is based on a nugget of reality, it's relying on an awful lot of wild conclusion-jumping. And it's ignoring some pretty significant parts of the bigger smartphone picture.

Let's break it all down and see if we can't wrap our moist gray matter around what's actually happening, shall we?

Google Pixel sales: The cold, hard facts

First, the foundation of all this chatter: In its quarterly earnings report this week (zzz...oh, hello!), Google parent company Alphabet revealed that sales of the Pixel phone had dropped from the first quarter of 2018 to the first quarter of 2019. The company's Person With An Important-Sounding Acronym-Based Title said it was "in part" because of "heavy promotional activity industry-wide" resulting from the "recent pressures in the premium smartphone market."

Allow me to translate that out of corporate robot-speak: In this one particular quarter of the year, Google sold fewer Pixel phones than it did during the same quarter one year earlier, possibly because every other phone-maker was marketing the hell out of its higher-profile high-end devices in order to compete for an ever-shrinking pool of new phone purchases. By how much Pixel sales fell, we don't know. In fact, beyond that one little tidbit of info, we don't know much of anything specific on the subject.

What we do know, however, is the broader context surrounding Google's Pixel phone, its purpose, and its broader position in the smartphone market. And that knowledge is critical to keep in mind when trying to understand this recent revelation. Context, as we've said approximately 79.2 gazillion times in this column over the years, is everything.

In this case, three big asterisks stand out as being particularly relevant to Google's Pixel program progression:

1. Multiple signs suggest Google's market share is actually rising — and that smartphone sales in general are just having a tough time

Two different market analyses in recent months have pointed out an intriguing pattern: that throughout parts or all of 2018, Google's position as a premium phone-making player has improved considerably while the smartphone market on the whole has slumped.

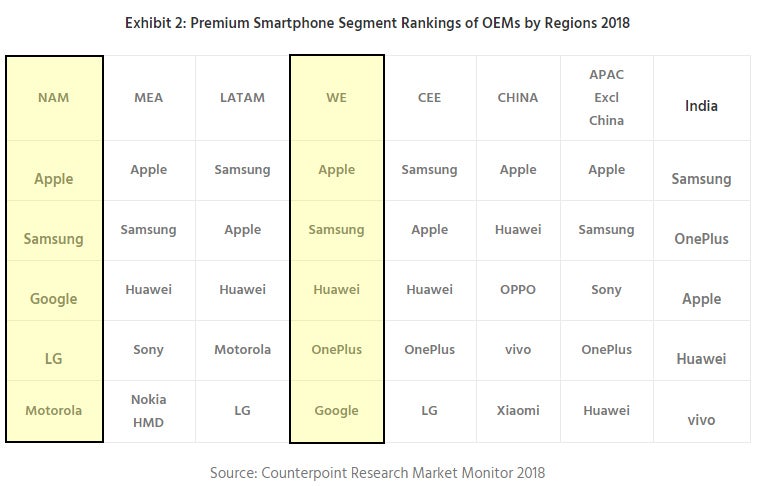

The most recent such report came along just a couple weeks ago from analysis firm Counterpoint. Its freshly compiled data indicates that Google broke into the elite club of top five "premium smartphone brands" for the first time in both Western Europe and North America when looking at sales numbers throughout all of 2018. In North America, specifically, Google was the third most successful premium smartphone player, according to the company's data — coming in from nowhere and outperforming everyone other than Apple and Samsung for that 12-month period.

Counterpoint Research

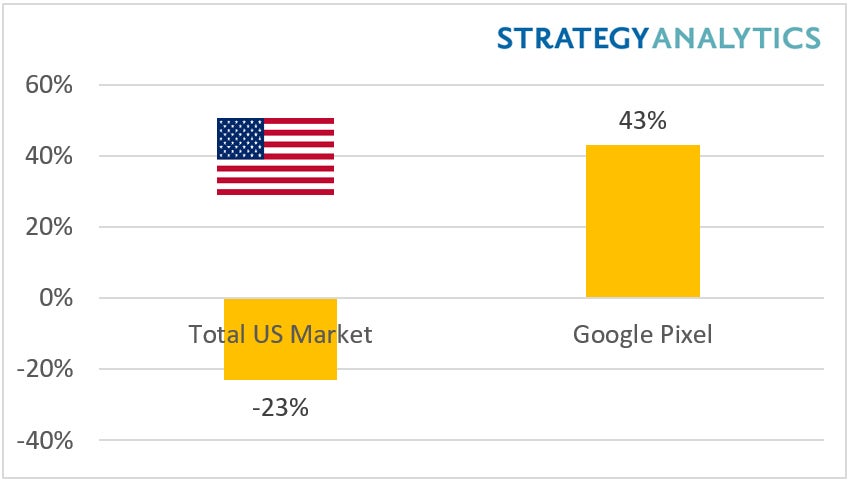

Counterpoint Research Findings from another analysis firm seem to support that same general pattern: Back in February, Strategy Analytics found that Google's Pixel brand was the "fastest-growing major smartphone brand" across the entire U.S. market for the fourth quarter of 2018 — outperforming everyone, including Apple and Samsung, in growth for that period.

In fact, the firm notes, U.S. smartphone shipments on the whole dropped by 23 percent during that time — one that includes the traditionally fruitful holiday season, no less — while Google's Pixel shipments shot up by a whopping 43 percent. Quite the contrast, to say the least.

Strategy Analytics

Strategy Analytics Suffice it to say, that context matters. The real story here seems to be that smartphone sales have been tough all around for a while now. Just this week, IDC noted that global phone shipments fell nearly 7 percent in that same first-quarter time frame at the heart of the Pixel conversation, with decreases experienced by everyone other than Huawei (which operates outside of the U.S. market). Heck, even the typically bulletproof-seeming Apple has seen plummeting iPhone income in recent quarters, with The Wall Street Journal estimating a 17 percent drop in iPhone-related revenue for the first-quarter period.

So when we talk about the state of Pixel sales in this present moment, we have to bear in mind that bigger picture of what's going on everywhere as all of us (understandably) hang onto phones for longer and phone-makers increasingly lean on silly gimmicks with no practical value to try to goad us into opening our wallets more often. Equally important, we have to remember that, by multiple accounts, Google has managed to buck those trends in many recent periods.

Plain and simple, it's all relative.

2. Google still sells the Pixel only in a single U.S. carrier's stores — and across a measly 12 countries

Here's where things get especially interesting: That aforementioned relative progress has been happening despite the fact that Google's Pixel phone is presently sold only by Verizon in America. Sure, the phone is compatible with any U.S. network and can be bought unlocked directly from Google and then used wherever — but nonsensical as it may seem to us earthlings in the know, the vast majority of phone-buying humans in America still waltz into carrier stores when they're looking to buy new phones. And in the vast majority of U.S. carrier stores, the Pixel doesn't exist as an option.

What's more, from the get-go, the limited marketing of the Pixel has served to reinforce the idea that the phone is available only to those on Verizon — with misleading language describing the device as a "Verizon exclusive" or saying it's available "only" on Verizon's network. You and I may know that's a carefully crafted (and likely contract-driven) game of semantics, but an average Joe hearing such phrases immediately assumes the phone isn't available to him on his non-Verizon carrier and thus isn't relevant to his life.

It's a painfully archaic method of distribution that brings to mind the early days of smartphone sales — when "carrier exclusives" were common and people were willing to switch providers in order to get some exciting new device. These days, even with the "exclusivity" being limited to where the phone is physically sold, all such a setup does is severely limit the exposure and distribution of the associated product.

Compare the Pixel's availability and marketing with that of the iPhone's or the latest Galaxy device's — in the U.S. and beyond — and the fact that Google's phone brand is generally managing not only to hang on but also to increase its relative position in the market over time is a practically miraculous feat.

3. What we're seeing now is still only the tip of the iceberg

Beyond those two colossal areas of consideration, there's one more asterisk to acknowledge: Unlike nearly every other phone-maker out there right now, Google has just a single phone model for sale at the moment (in two sizes) — and its phone brand has existed for a mere three-and-a-half years.

From day one, the company has made it clear that this is a long-term plan with modest short-term expectations. In an interview with The Verge in late 2016, Google Hardware VP Rick Osterloh laid it out as plain as could be:

"We certainly aren’t going to have enormous volumes out of this product. This is very first innings for us." Google's metric of success for Pixel won't be whether it picks up significant market share, but whether it can garner customer satisfaction and form retail and carrier partnerships that Google can leverage for years to come.

When you think about everything we just discussed in the previous two points alongside that logic, it all takes on a pretty different meaning — doesn't it?

And the story doesn't end there.

The bigger Pixel picture

Abstract goals aside, signs suggest Google is on the brink of unveiling a lower-priced, midrange model of its Pixel phone — and that the phone's launch could be accompanied by an end to Verizon's "exclusive" deal on selling the Pixel line in America. Given everything that's happened so far with the Pixel being sold only by a single U.S. carrier, imagine how things could progress with the phone being available and promoted in even two carriers' stores across the country.

Consider, too — as I've ruminated before — that, logically speaking, a midrange Pixel is almost certainly just the start of the Pixel line's expansion:

At its core, the Pixel was designed to "fix" Android, from Google's perspective — to provide a vessel for the platform in which Google's vision and its services can take center stage and shine. Google's made no bones about this. And ultimately, it's a mutually beneficial arrangement for both Google and for you: You get the best-in-class setup the "full Google experience" provides, while Google gets all the business benefits that come from having you fully committed to its services.

[So] of course Google wants to expand beyond a single pair of high-priced Pixel models. Of course the company has always intended to offer more affordable "Google experience" options. ...

An announcement of a midrange Pixel in and of itself may not seem like an earth-shattering development, but like so many other things in the Google universe, you have to see the forest for the trees. You have to realize that this'll represent the beginning of a whole new phase in a massive, multipart effort — and you have to consider the broader canvas that's slowly but surely being filled in, one little corner at a time.

Remember, too, that Google isn't like most other device-makers. Its primary goal with the Pixel almost certainly isn't to move billions of units immediately and turn Alphabet into a company that depends on hardware sales for a sizable chunk of its income. Google, first and foremost, is an ad company. It makes the vast majority of its money by selling ads that are shown on the internet — and practically everything it does ends up supporting that effort in some way.

To once again quote a devastatingly handsome writer I know, with the Pixel, Google is playing its own game — and, specifically:

The Pixel supports Google's core business by providing a standard of comparison to which other Android devices are already being held. It demonstrates the benefit of putting Google services front and center in a way that lets them shine (and in a way other Android manufacturers often opt to avoid). It gives Google its own fully-controlled vessel both for Android itself and for the various other software developed alongside it — and that, in turn, allows Google to better advance both the overall user experience it presents and the individual software elements it then pushes out to countless devices across multiple platforms.

The benefit to us as users is apparent in the products, but this approach also pays off for Google — because the better Google's services and software are, the more time people will spend using them. The more time people spend online, the more data Google is able to collect and the more effective ads it's able to deliver.

See how this all comes together? The long-term picture of how successful Google's Pixel program proves to be simply isn't something we can assess in any meaningful way at this point. Yes, there's little real question that Google has a long way to go in terms of figuring out how to effectively market its products, get them out in front of phone-buyers, and make sure even average Joes understand what value they offer over the often-flashier alternatives. And yes, there's a reasonable argument to be made that Google may give up or otherwise get in its own way and muck things up at some point along that path.

For now, though, trying to extrapolate broad meaning from a limited window of sales numbers — and viewing that data without the full context around it — is nothing more than lazy conclusion-jumping. The tech-watching world has long suffered from a tendency to see things from a myopic perspective. In order to appreciate the true picture of what's going on with Google's phone program, we need to put on our glasses and look beyond the single snippet of data that's right in front of our faces at this one particular moment — because that single snippet of data is but one small piece of a much bigger story.

Sign up for my weekly newsletter to get more practical tips, personal recommendations, and plain-English perspective on the news that matters.

[Android Intelligence videos at Computerworld]