Generative AI has the potential to boost workplace productivity, automating tasks such as drafting emails and providing meeting summaries. But deciding how much businesses should pay to access these tools can be a conundrum for software vendors.

“This is untested technology, both in terms of what it can do and how you can monetize it,” said Craig Roth, a research vice president at Gartner. “What you see is vendors experimenting: they’re trying [to balance] actually making revenue off of this with trying to negotiate some market positioning and competitive advantage.”

In the months since OpenAI’s ChatGPT launched, large language models (LLMs) have been applied to many software tools, with collaboration and productivity apps seen as a key use case. Common capabilities include automated note-taking during meetings, summarization of text chat and email transcripts, email draft generation, advanced document search, and even image generation for presentation slides.

Different pricing strategies have emerged for access to these features, with some vendors charging premium prices while others opt for lower costs in the hope of spurring uptake among business customers.

While it’s standard for software vendors to price similar services at different levels as they vie for market share and profitability, the relative novelty of generative AI brings some specific challenges. On one hand there’s the compute cost to process user queries and how quickly this cost might fall. Then there’s the question of what benefits these tools will actually provide to customers and, ultimately, how much organizations are willing to pay.

Altogether, settling on a dollar value means grappling with several unknowns. “It’s kind of a dance right now between the vendors and the customers to figure out what the right price point is,” said Roth.

Who’s charging what for genAI features?

A year on from the launch of ChatGPT 3.5, most office software vendors have at least announced plans to embed generative AI features within their products. In many cases, these tools are now accessible to at least to parts of their customer base.

Notion was one of the first productivity vendors to make its genAI features available, back in February, at an additional $10 per user each month.

Since then, a variety of genAI tools for office apps have hit the market, with varying approaches to how they are sold.

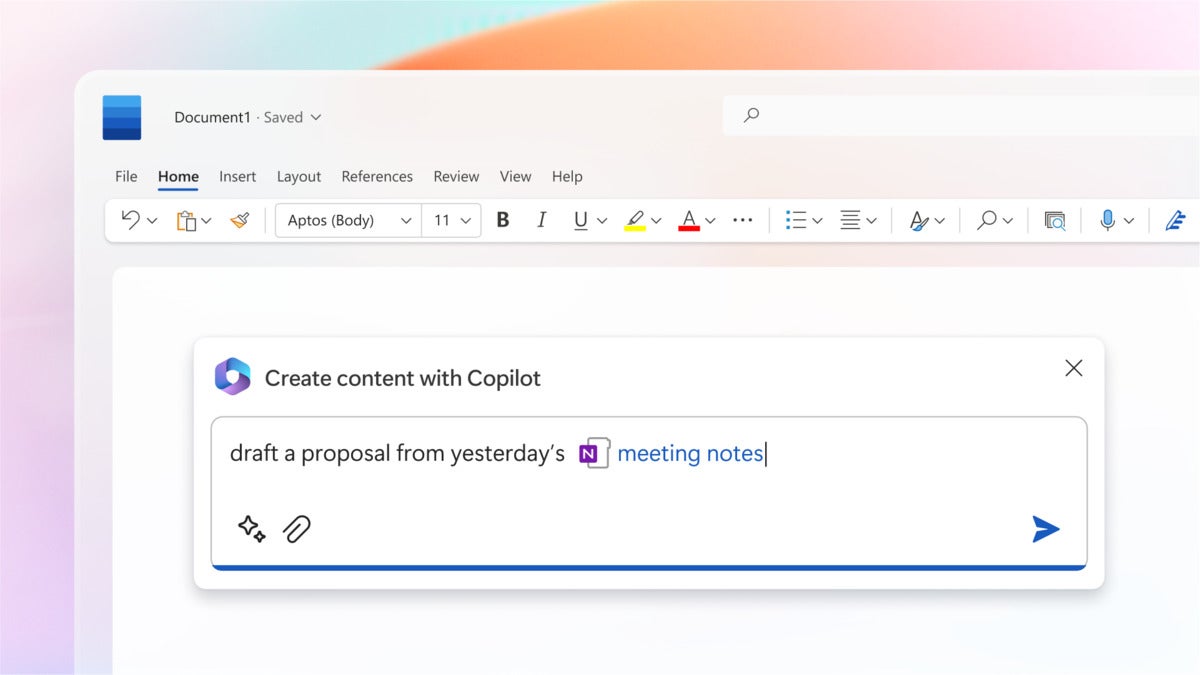

In some cases, a premium is charged. Microsoft, for example, launched its Copilot for Microsoft 365 to large customers in November, with a listed price of $30 per user per month on top of E3 and E5 subscriptions (and a minimum purchase of 300 seats). This provides access to Copilot functionality within its range of office applications, including Word, Outlook, and Teams. The price for smaller businesses is yet to be announced, with an SMB early access program currently underway.

Microsoft

Microsoft

Microsoft 365 Copilot can help a Word user draft a proposal from meeting notes. (Click image to enlarge it.)

Microsoft also has a cheaper option for accessing some AI assistance: the Teams Premium plan, priced at $7 per user per month, provides access to some generative AI features based on OpenAI’s ChatGPT models — recapping meeting conversations and generating notes, for instance.

Google, another major office app suite vendor, launched Duet AI for Workspace in August, with genAI features available in apps such as Gmail, Sheets, and Docs. Access to these features is available as an add-on to paid Workspace accounts, costing $30 per user per month, a Google spokesperson said. There is, however, no mention of this price clearly visible on Google’s website at time of writing. Customers are instead pointed to a free trial, which lasts 30 days, according to the spokesperson.

It’s widely believed that, in the case of both vendors, these prices are negotiable for large customers.

Other vendors are making generative AI features available at no extra cost to paid customers.

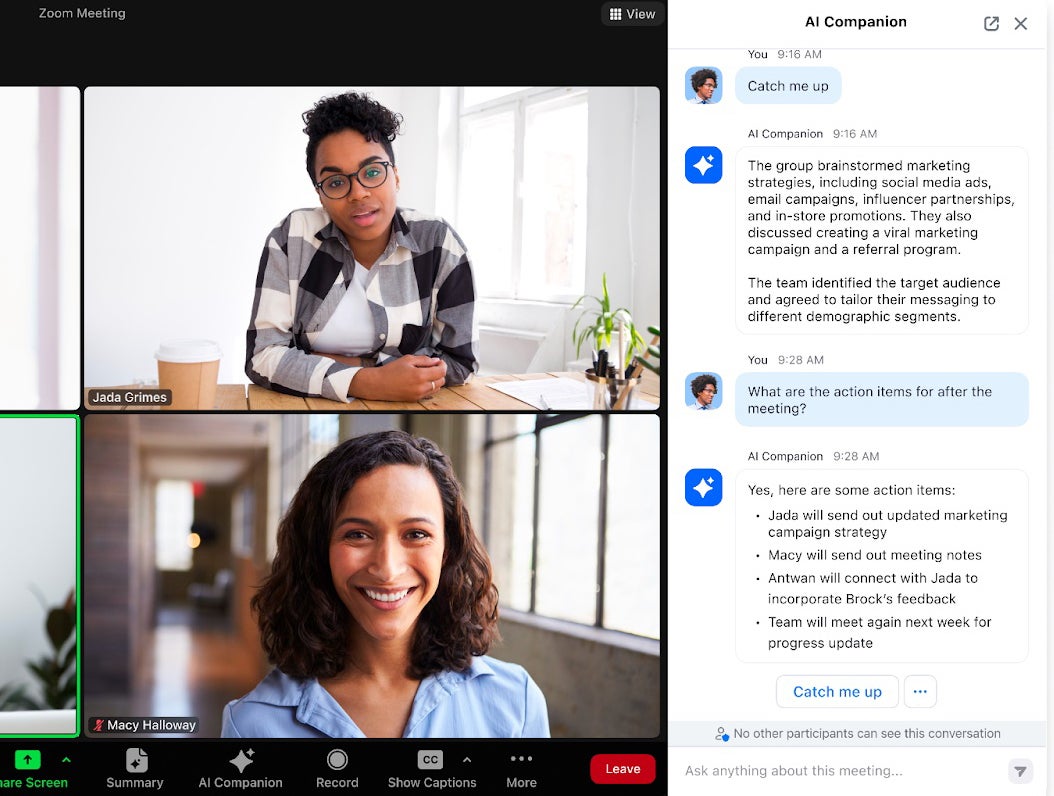

Zoom’s AI Companion provides a range of generative AI features across a product portfolio that extends beyond its initial focus of video meeting software. As well as interactions with the AI Companion during video calls — such asking for any action items — the AI assistant can generate email drafts, draft text chat messages, and create content for Zoom’s digital whiteboard app. (More than 220,000 customer accounts have enabled the AI assistant, Zoom’s CEO Eric Yuan said in the company’s recent financial results.)

Zoom

Zoom

If you’re late to a meeting, Zoom’s AI Companion can catch you up. (Click image to enlarge it.)

Others in the collaboration and productivity space that have taken a similar position on pricing include Cisco with its Webex AI Assistant, and all-in-one workplace app vendor Coda.

Another option is to provide credit-based access to genAI tools.

Box has opted for this approach with its genAI offering, Box AI, which is currently available in beta. In this case, customers on Box’s paid Enterprise Plus tier can run a certain number of queries at no extra cost, with a cap at 20 queries per user each month. An additional 2,000 queries are also provided at the company level. According to a TechCrunch report in October, customers that go over this limit will be able to purchase “additional blocks of AI credits.” Box didn’t respond to Computerworld’s request for Box AI pricing and usage details.

Other vendors have yet to announce pricing, with Slack still trialing genAI features in private preview ahead of wider availability next year, for example.

Finding the right balance

There are obvious competitive advantages to offering generative AI features at no extra fee — and good news for customers — but it’s unclear how vendors doing this will balance lower prices with their own running costs. As an example, Microsoft’s GitHub Copilot is reported to have been run at a loss — to the tune of $20 per user each month on average, with some individual power users apparently costing Microsoft $80 each month — according to a Wall Street Journal report in October.

“GenAI is quite expensive to offer,” said Gartner’s Roth. “It costs a lot of money: whether you license one of the big large language models or try to create your own, there’s a lot of processing power involved.”

Even if it helps them grow market share in the short term, software vendors may feel the pinch if customer usage grows substantially. Those currently offering genAI assistants for free will likely “move to a tiered and/or usage-based model going forward,” predicts Irwin Lazar, president and principal analyst at Metrigy.

The converse challenge for pricing is not charging too much, as some customers may be reticent to invest significant sums on a new technology that’s just coming to market.

“[On] the customer side, the value part of it has been really vague,” said Roth. “‘Exactly what am I getting out of this?’ If you’re just using it to improve your productivity to convert paragraphs into bullets or start your emails for you, it feels great, but exactly what is the value that you’re getting out of it? Can you put a dollar amount on it?”

It’s likely that many businesses will take a cautious approach to investing in genAI features in the early stages of availability in any case, with cost just one potential factor here. (There are other reasons to move slowly, such as potential data governance challenges.) Microsoft expects revenue related to Copilot for M365 to “grow gradually over time,” Microsoft CFO Amy Hood said during the company’s Q1 2024 earnings call. Copilot will be subject to the usual “enterprise cycle times in terms of adoption and ramp,” CEO Satya Nadella noted on the same call.

“Right now, our research shows a high level of interest in genAI tools, but companies aren’t yet committed to paying for them until they better understand ROI,” said Lazar at Metrigy. “I expect that we’ll see limited adoption of Copilot [for Microsoft 365] and [Google Workspace] Duet in the next six to 12 months as companies conduct trials to see if there is actual identifiable ROI.”

How will this all play out?

For the time being, customers of the largest office app suites can expect to a pay a premium for these services. “I expect genAI features to remain an add-on for major productivity suites for the next one to two years, perhaps longer,” said Jack Gold, founder and principal analyst at J. Gold Associates.

This protects vendors such as Microsoft and Google against high running costs, ensuring a manageable number of customers accessing services in the early months of availability. “It also gives them the opportunity to increase the quality of the program based on the usage of a relatively limited audience, but one that makes good use of the functionality,” said Gold.

Roth also estimates that premium prices are likely to hold for the next six months at least, perhaps a year, before starting to fall. This is because the underlying technologies — particularly the high-end chips used to power LLMs — are set to become cheaper and more efficient.

Looking a bit further out and, it’s likely that genAI will simply become table stakes for any productivity or collaboration software package. Gold estimates that, in a timeframe of around three years, genAI will be an “integrated capability” in most productivity suites, seen as standard functionality by users rather than as an optional add-on — in which case, any costs for providing genAI features will essentially be built in via price increases to core products, he suggests.

But accessing genAI doesn’t have to require significant investment in the short term. “There are other ways of doing this,” Gold said, with the ability to access a version of Microsoft’s Copilot in the Edge browser, for instance. Unlike Microsoft 365 Copilot, the Copilot in Edge isn’t fully integrated with Microsoft 365 apps like Word and PowerPoint, but it does offer useful generative capabilities. “You can do things like give it text and tell it to summarize that or turn it into bullets, modify the tone, or whatever and then paste it back.”

There are also AI writing assistant tools that can provide some genAI features for free, though businesses should always be wary of where their data is being stored and processed. “There are ways around this, especially if you’re not an extremely heavy user,” said Roth. “So there is competition to [those selling genAI features at a premium]. You don’t have to go with the genAI built into the productivity suite in a lot of cases.”