PC sales dropped by more than 25% year-over-year in the last quarter of 2022, as did the prices for the hardware that did sell, according to several reports from industry research groups.

Every major PC vendor saw the heavy declines in PC sales, with Dell Technologies hardest hit in the fourth quarter; it experienced as much as a 37% drop in sales. Apple was the least affected, with as little as a 2.1% decline. (The figures vary somewhat depending on reports from IDC, Gartner and Canalys.)

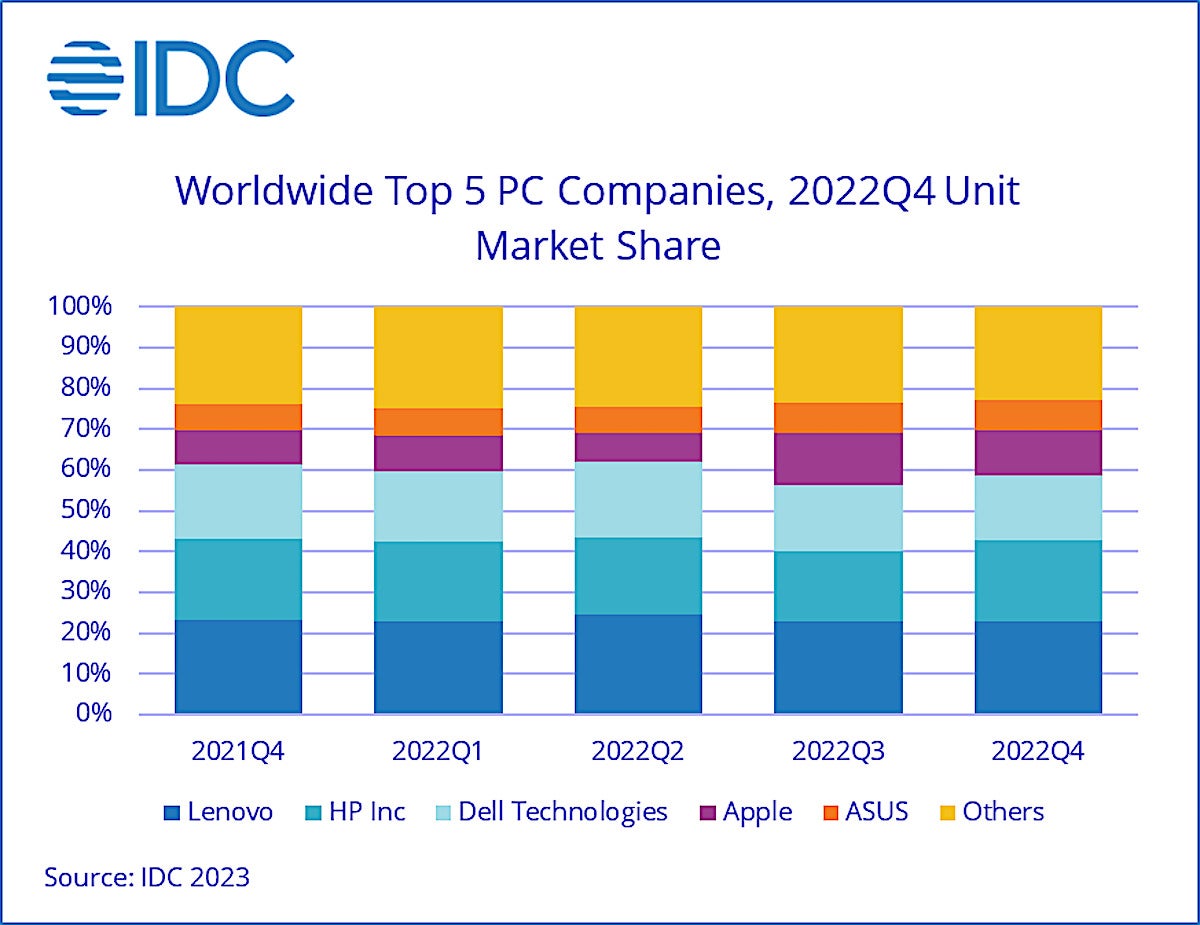

The sales declines didn’t reshuffle the top three worldwide PC vendors with Lenovo maintaining its top spot, followed by HP and Dell.

While Lenovo retained 24% of the market share, it also endured its steepest decline since research firm Gartner started tracking the PC market. Lenovo’s shipments fell in all regions except Japan, declining by more than 30% in Europe, Middle East and Africa (EMEA) and Latin America.

HP and Dell also saw historically steep declines. HP was hit hardest in the EMEA market, where shipments fell 44% year-over-year. For Dell, weak demand in the large business market affected shipments in the second half of 2022.

The EMEA PC market suffered a historic decline of 37.2% year-over-year due to the intersection of political unrest, inflationary pressures, interest rate increases, and recession fears, according to Gartner.

The Asia Pacific market (excluding Japan) declined 29.4% year-over-year, mainly due to the market in China. While the fourth quarter has traditionally a been peak season for China’s business PC market, budget cuts by the Chinese government and uncertainty around COVID policies led to a significant drop in overall PC demand, Gartner said.

For all of 2022, laptop and desktop sales were down about 16% compared to 2021, according to all the three reports. Last year's decline was somewhat cushioned by a nearly historic year in PC sales in 2021, where year-over-year growth was around 15%.

IDC

IDCMikako Kitagawa, a director analyst at Gartner, said 2022's precipitous drop can be attributed to the global inflation, higher interest rates, and the anticipation of a global recession, which has yet to materialize.

“The enterprise PC market is also being impacted by a slowing economy,” Kitagawa said in a statement. “PC demand among enterprises began declining in the third quarter of 2022, but the market has now shifted from softness to deterioration. Enterprise buyers are extending PC lifecycles and delaying purchases, meaning the business market will likely not return to growth until 2024.”

Canalys

CanalysRyan Reith, group vice president with IDC's Worldwide Mobility and Consumer Device Trackers, said consecutive quarter-over-quarter declines in 2022 does paint a “gloomy picture of the PC market,” but it’s really about perception.

“There’s no question when we look back at this time that the rise and fall of the PC market will be one for the record books, but plenty of opportunity still lies ahead.," he said. "We firmly believe the market has the potential to recover in 2024 and we also see pockets of opportunity throughout the remainder of 2023."

IDC’s report, which pegged the PC sales plunge at 28.1% in Q4, echoed similar numbers from research firms Canalys and Gartner, whose estimates showed a 29% and 28.5% drop, respectively.

The sales figures include computers running Windows, macOS, and the Chrome operating systems.

“As expected, the global PC market faced further headwinds in Q4 to round out what has been a difficult 2022,” Ishan Dutt, senior analyst at Canalys, said in a report.

A December poll of around 250 PC channel partners by Canalys showed that 60% expect revenue to remain flat or decline in 2023.

“Despite the short-term difficulty, the long-term outlook for PCs remains positive," Dutt said. "Shipments in 2022 were down by 16%, and we expect a further contraction in 2023, but in both years, total volumes will remain higher than in the pre-pandemic era of 2019. This challenging environment for the PC industry is anticipated to last until the second half of this year.”

IDC

IDC

The top 5 PC companies by sales, worldwide.